TransferWise Review – Best PayPal Alternative [8x Cheaper & Faster]

Global payment solutions and online money transfer services are becoming a basic necessity with time for many of us.

As more and more people are leaving their jobs and migrating to online businesses like e-commerce, blogging, freelancing, etc.

We all make use of payment and money transfer services like PayPal and Strip in order to send or receive money globally.

And these payment services take a small part of our fees to transfer money from one part of the world to another.

But the issue is, these services have –

- high transfer rates

- and provides low conversion rates.

Which hurts a lot to people! That’s where TransferWise comes in!

An online money transfer service that cuts out all the massive amount of fee that banks charge to send money across borders.

Let’s move directly to the TransferWise Review where you will get to know – What is TransferWise? and How you can save $$$ by using TransferWise as your payment method?

Table of Contents

What is TransferWise?

TransferWise is the cheapest and fastest online money transfer service to send money abroad.

No wallet is provided by TransferWise as the money directly gets transferred to the receiver’s or recipient’s bank account.

The best things I personally liked about TransferWise are –

- Cheapest transaction fees.

- Real-time or mid-market exchange rates.

- No TransferWise account needed on Receiver’s end, just a bank account or Money is sent directly to the recipient’s bank account.

- Transparency.

- No hidden fees.

TransferWise offers 2 sending channels to send money abroad –

- Website

- Mobile App

- Android

- iOS

How Does TransferWise Work and Why TransferWise is 8x cheaper Than Bank & Other Online Payments System?

Let’s take a look at how TransferWise works.

You all are aware of the fact that banks, brokers and other money transferring services like PayPal & Stripe –

- Overcharge for abroad money transactions, and

- Adds a secret fee by offering you a poor exchange rate.

These hidden charges do matter to us who are receiving money from foreign countries.

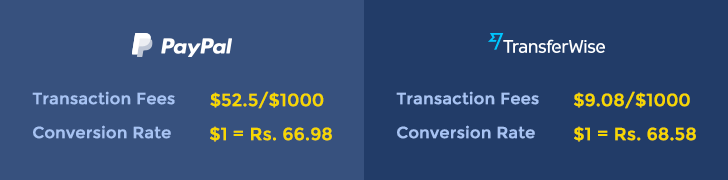

TransferWise is a perfect solution to the transaction fees and hidden charges cut! As it provides cheapest transfer rates among all the money transfer services present in the market.

But how?

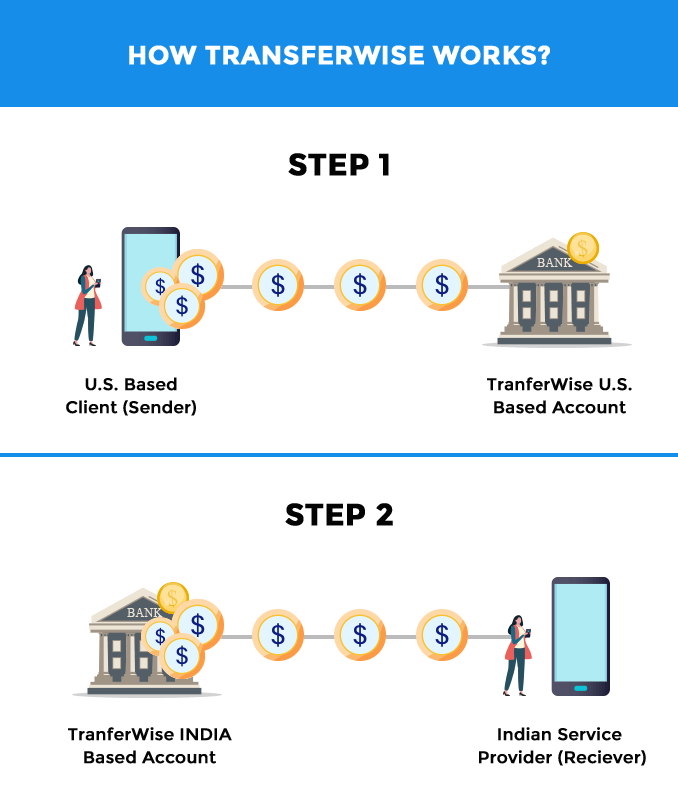

Well, TransferWise uses 2 local or domestic transfers instead of one international transaction.

For example, When a U.S. based clients send money using TransferWise, they actually send the money to TransferWise’s U.S. based account. TransferWise then sends the equivalent amount from its India based account to your account.

The TransferWise process is really amazing and simple which also means –

- The money never actually moves across borders,

- No international transaction, hence no international transaction fees.

- High currency conversion rates due to local transfers.

- Avoided all the traditional banking fees of an international transaction.

TransferWise Exchange Rates

Another best thing about TransferWise money transfer platform is that –

- It provides real exchange rates, unlike other money transfer services.

TransferWise converts your money using the true mid-market rate when they receive and process your money.

TransferWise locks the exchange rates for a specific time frame to avoid the exchange rate fluctuation issue. This locked exchange rate is also known as the guaranteed rate.

For most countries (which includes India), the time frame is 24 hours.

For several others, the time frame is 48 hours. And for BRL (Brazilian Reals), the time frame is 72 hours.

What is Real Exchange Rates? A real exchange rate can be defined as the comparison of the relative currency price of two countries. You can check the real exchange rates on Google, XE, and Yahoo.

TransferWise provides real exchange rates unlike its competitors PayPal and Stripe.

It provides the exact rate you see on services like Google, XE, and Yahoo.

The exchange rates provided by TransferWise are approx 8x cheaper than bank transfer rates.

TransferWise Fees: How Much Does it Cost?

TransferWise offers complete transparency in its process. This online money transfer tool charges –

- A very small percentage of total sending amount which is TransferWise Fees

- And a flat fee of certain transfer routes depending upon the country.

1. TransferWise Fees

Below are some examples to give you an idea –

1. GBP (British Pound) to EUR (Euro)

Costs 0.35% of the transfer amount with a fee of £0.80.

2. EUR (Euro) to GBP (British Pound)

Costs 0.5% of the transfer amount with a flat fee of €2.

3. DKK (Danish Kroner) to Euros

Costs 0.5% of the transfer amount on the initial DKK 50,000. After this amount, it charges 0.3%.

4. USD to INR

Costs approx 0.6% of the transfer amount.

2. Other Fees

TransferWise uses local accounts to receive and send money which eventually avoids the bank fees.

But what if you’re paying using a debit card or credit card or using SWIFT Code?

Well, in that case you will be charged some amount depending upon the currency you’re sending and the card you’re using to send the money.

1. Debit Card

Free for few currencies, but charge 0.15%-2% for the other.

2. Credit Card

Charge 0.3% to 2% depending upon the currency.

3. Swift Code

TransferWise sends few currencies using SWIFT Code. Make sure you know how much the receiving bank charges for incoming SWIFT payments.

TransferWise SWIFT currencies are –

- JPY (Japanese Yen)

- ZAR (South African Rand)

- USD transfer to a non-U.S. bank account.

How Long Do Transfers Take? Or How Much Time Does it Take to Transfer the Money?

TransferWise displays the estimated date it will take to transfer the money in the pricing widget.

But, there are 4 things on which a TransferWise transfer speed depends on –

1. The Countries You’re Sending Money From and To –

Country of the sender and receiver plans an important role in a TransferWise transfer.

For instance, some countries take up to a maximum of 2 working days for currency conversion.

On the other hand, in some countries, a fast transfer depends on how quickly the recipient’s bank processes the money.

2. Which Transfer Type You’re Using To Send The Money?

The speed of the TransferWise transfer may vary depending upon the payment method or transfer type chosen to send the money.

Some transfer types are faster than others. For example – Card payments normally complete in an instant.

While on the other hand, bank transfers take more time to complete in comparison to card payments.

3. At What Time You’re Transferring the Money?

TransferWise handles money only during normal banking hours and working days.

There is a possibility that you might not receive money on National holidays and non-working days.

4. Security Checks

TransferWise sometimes ask for ID, address, etc before sending the money as a verification and security checks.

Obviously, it does this process to keep the money transfer secure and safe.

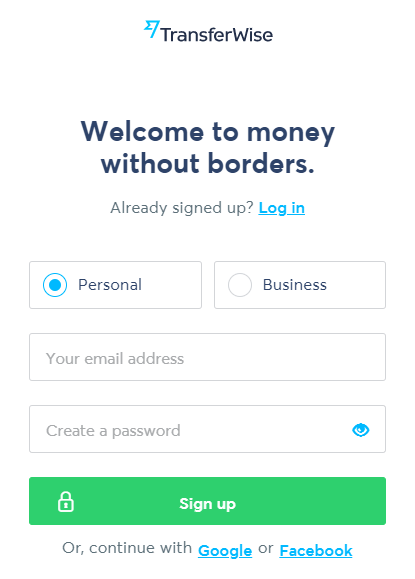

How to Get Started and Sign Up in TransferWise?

Creating an account in TransferWise is free and easy. It takes a few seconds to sign up in TransferWise.

To get started, all you need to do is to follow the below steps –

1. Open up TransferWise Website and click on ‘Register’.

2. TransferWise offers 3 ways to sign up.

- Email Address

3. Also, 2 types of accounts –

- Personal

- Business

4. Choose the signup method and account type and click on ‘Sign up’.

How to Send Money Internationally Using TransferWise? Or How to Setup Your First Transfer in TransferWise?

1. Setup Your First Transfer

After the signup, it will redirect you to the dashboard where you can set up your first transfer.

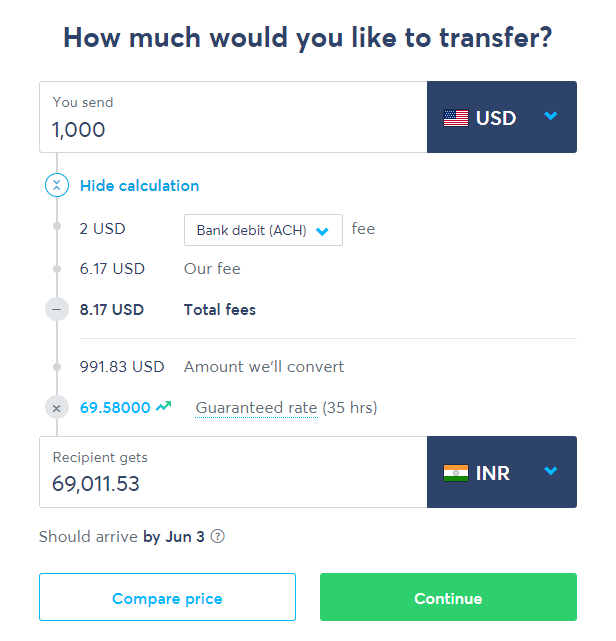

2. Choose Sending & Receiving Currency and Transfer Type

Here, you can enter the amount you want to send and choose –

- Sending currency,

- Receiving currency, and

- Transfer type.

Once you select the above three, it will display you the total transaction fees to send the amount you entered and estimated time to transfer.

It will also display the mid rate conversion rate for the receiving currency.

After completing the above process, you can click on continue.

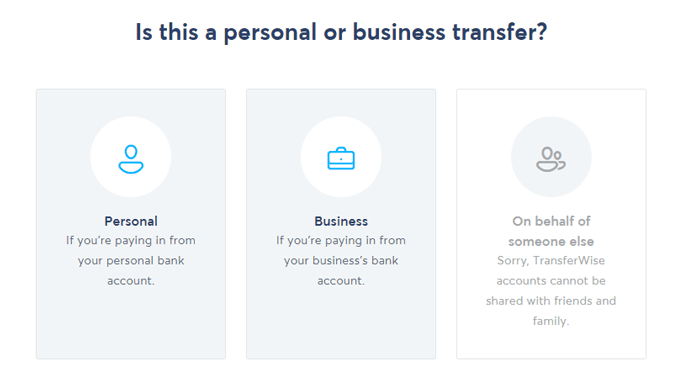

3. Choose Transfer Type – Personal or Business?

After that, it will ask you to choose the transfer type whether the money is going to deduct from –

- A personal account or

- A business bank account.

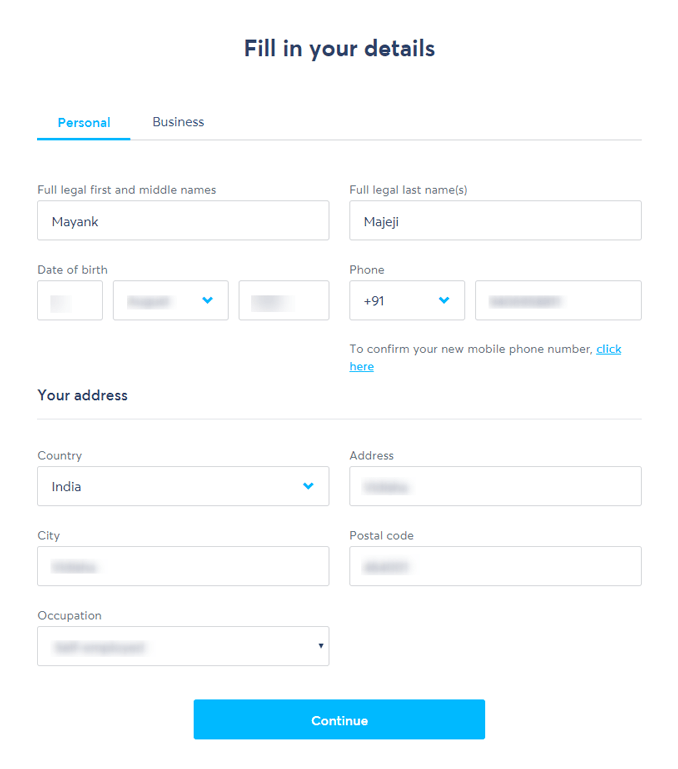

4. Enter Personal Details / Business Details

Once you choose the account type, it will ask you to fill more details.

If you’ve chosen Personal Account, it will ask –

- Name

- Date of birth

- Phone Number

- Address details

For Business Account, it will ask Business Details like –

- Country,

- Business name,

- Company type,

- Your role in the company,

- Registration number

- Website

- Business Category & Subcategory

- Business Address

- And Your Details.

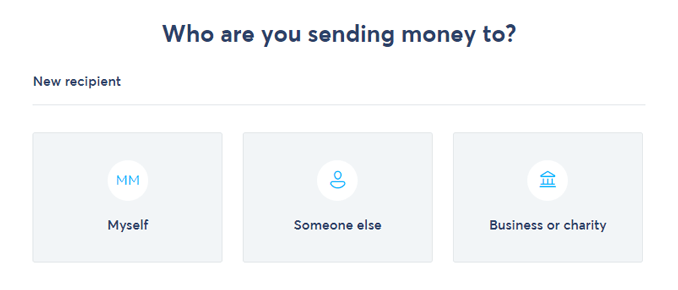

5. Choose Recipient Type

After filling the details, it will ask you who do you want to send the money –

- Myself

- Someone Else

- Business or charity

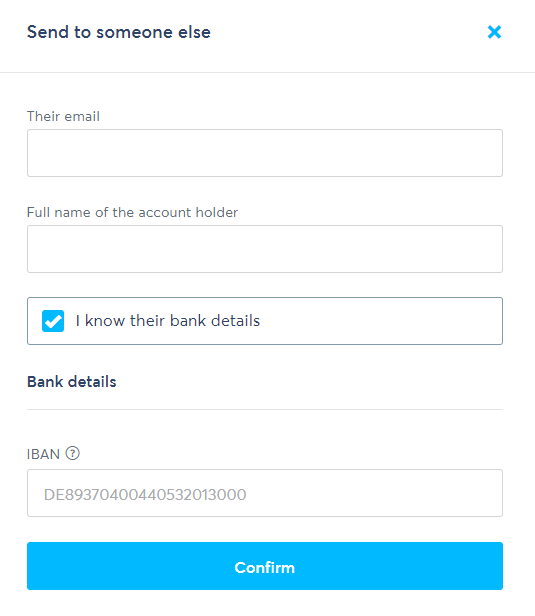

6. Enter Recipient Details

It will then ask for the recipient details –

- Recipients Email Address

- Full name of the Account Holder

- IBAN (International Bank Account Number)

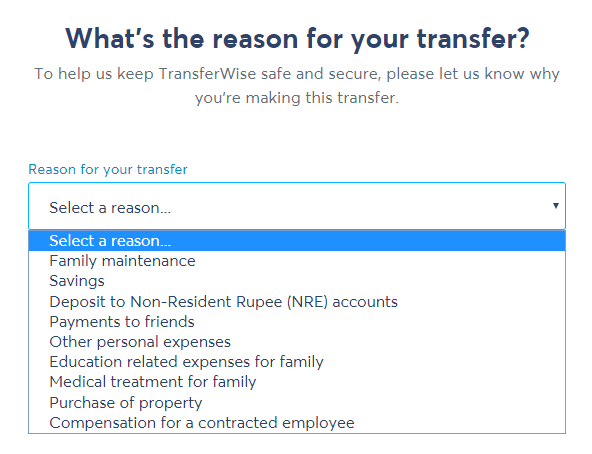

7. Reason of Transfer

In some cases, TransferWise asks for the reason to transfer. Select the appropriate reason and click on Continue.

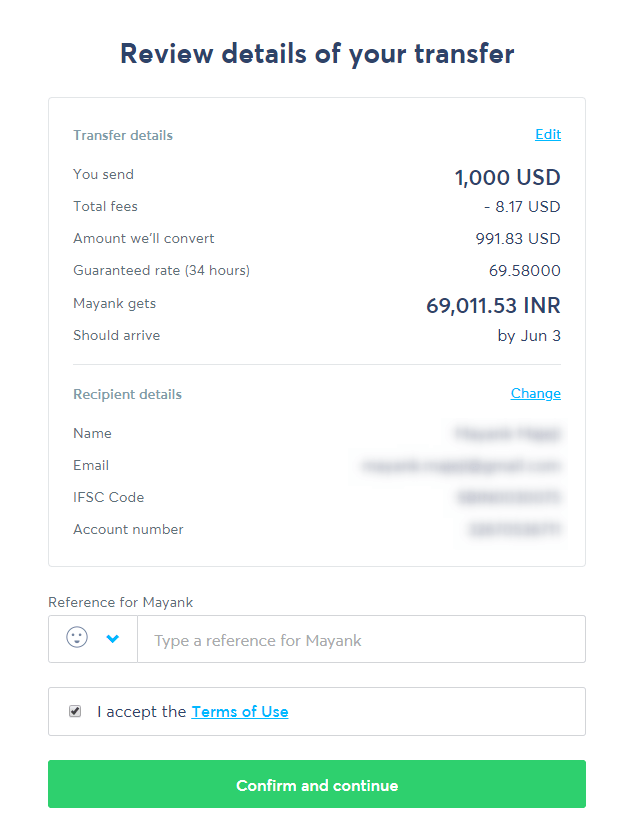

8. Review The Transfer Details

After that, it will ask you to review all the details you have selected and entered in previous steps. If the details are correct then check the checkbox in front of I accept the Terms of Use and click on Confirm and Continue.

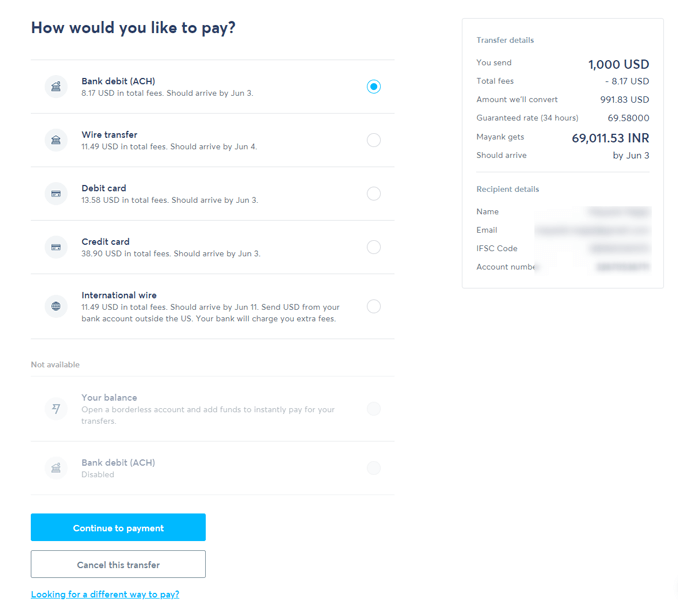

9. Select Payment Method

Next, You need to select your desired payment method and click on continue to payment.

10. Complete The Payment

It will then redirect you on the payment page, all you need to do is to pay the amount and you’re done.

Once you complete that last step, it will start the money sending process.

Is TransferWise Support Responsive Enough?

1. Customer Care

I personally found TransferWise customer support to be super responsive and helpful.

I’ve had multiple chats with them via Email and Facebook and I’ve got proper and timely replies each time.

One of the major reasons behind their timely replies is that –

- their team is spread across the globe, so no matter what timezone you’re in, you can always expect a reply from TransferWise support.

- You can also contact them via call.

2. TransferWise Knowledgebase

TransferWise knowledgebase is one hell of a resource, it has almost all the answers you might be looking for.

Is TransferWise Safe and Secure? Can You Trust TransferWise?

When I first used TransferWise, I had the same question regarding security.

But after a few transactions, I was completely assured that it’s perfectly secure and safe for online money transfer.

But that’s my personal experience and for you, I’ve something official to make you believe the same.

Is TransferWise Safe & Secure as a Peer-to-peer Service?

Well, Yes!

TransferWise is a peer-to-peer service but it doesn’t match you with any other person on the receiving end.

Instead, it is the company itself that transfers the money as they have a large number of currencies across the world.

TransferWise is Licensed and Regulated by Financial Bodies Across The World!

TransferWise is a licensed Authorised Electronic Money Institution regulated by the Financial Conduct Authority.

The headquarters of TransferWise is located in the UK where it is regulated by HMRC (Her Majesty’s Revenue and Customs).

TransferWise is also regulated by other regulatory institutions in other countries across the world.

So it’s completely safe and secure in all the countries around the world.

TransferWise Protects You Against Fraud & Money Laundering

TransferWise works just like large banks and financial institutions.

It verifies and authenticates its users in order to protect against fraud and money laundering.

My Recommendation and Thoughts About TransferWise!

I will recommend everyone to use TransferWise! As it is –

- Cheapest money transfer service in the market.

- Almost 8x Cheaper than banks and other payment services like PayPal and Stripe.

- Provides mid-rate exchange rates.

- Fast

- Easy to use.

- Completely safe and secure.

Let me know in the comments what you think about TransferWise.

Also, if you’re using any other service cheaper or approximately equivalent to TransferWise, I would love to know about it.